Millenials are fickle; they have no brand loyalty is an oft-repeated statement. I wholeheartedly agree with it. If we don’t like something or some other brand offers something better, we switch. We want our work to be completed faster while maintaining the same level quality; if it is also cheaper, that’s a great incentive, too. Which is why; today when we are going to discuss three new financial products launched by NPCI to revolutionize digital payments. I will not appeal to your emotions and tell you it is Made in India or use it to support your country. No, we are going to look at concrete benefits they offer and then make our decision.

So last week, I visited the headquarters of NPCI which is National Payment Corporation of India. To be honest, I didn’t know much about them. I had read a few mentions here and there in the newspaper but beyond that nothing. So what does the NPCI do?

NPCI is a not for profit company and is an umbrella organization for operating retail payments and settlement systems in India. It is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) and their job is to create a robust Payment and Settlement Infrastructure in India. They work on the principles of inclusion and equality and they strive to touch lives of every Indian through their initiatives. Their latest mission is to revolutionize digital payments in India

Mission to revolutionize digital payments

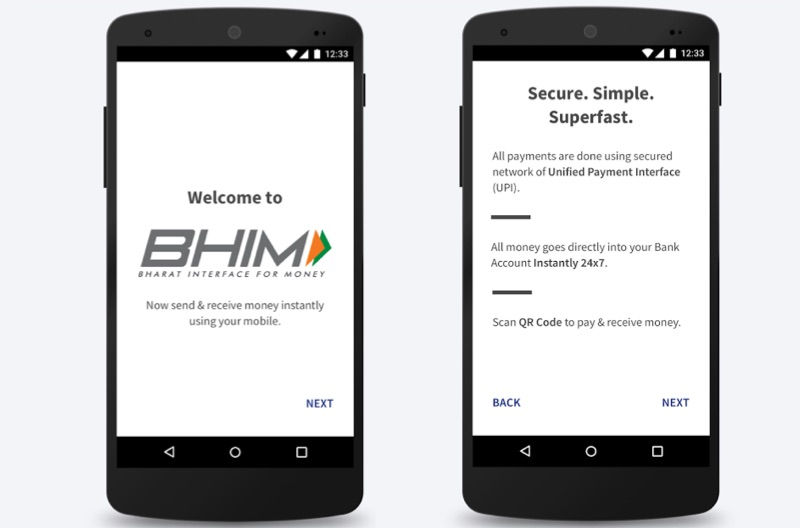

Of the several products launched by them through the years we are going to discuss two products that have received a lot of attention and appreciation recently. The first being BHIM or Bharat Interface for Money.

So what is BHIM and why should I care about it?

If you want to simplify life, then use BHIM. That is my one sentence answer but I want to talk about it a little more.

BHIM has been designed for everyone. From someone who owns an iPhone to someone who has a basic feature phone. Through BHIM, money transfers are as simple as sending a text message. You can transfer money 24 hours a day for 365 days of the year and the payment is credited instantaneously. You don’t have to wait for hours for your NEFT transfer, you can just do it with a click.

I hear you; you think BHIM is then just like any other e-wallet?

Absolutely no. What differentiates BHIM from all the competition is the fact that you can do direct bank account to bank account transfer using UPI ID or your Mobile number or your Aadhaar number or Account number and IFSC code. Do you now see BHIM ka Dum?

But wait, there is more!

With BHIM, you can generate and share your personalized QR code, get Instant notifications and transaction alerts, access BHIM App in your favourite language.

Do you want more? BHIM will give you more 🙂

BHIM has

- Round the clock availability

- Single Application for accessing different bank accounts

- It uses UPI ID which is more secure, no credential sharing

- Single click authentication

- You can raise complaint from Mobile App directly

I am sure you are curious about this UPI that I keep mentioning. Want to know more?

Unified Payments Interface (UPI) is an instant payment system developed by the National Payments Corporation of India. Basically, it allows you to instantly transfer money between any two parties’ bank accounts through your UPID.

UPID is your personal identification code, for example, I can make one that says Munniofalltrades@ABCBank.

But UPI does not restrict its access to people who have a UPID. If you have the account+ IFSC or Aadhaar number, you can still pay them money.

The third product that I will introduce you to is called RuPay. I personally have been using a RuPay card for nearly 6 months now and to be honest I did not know the true extent of its benefits till the NPCI Bloggers meet.

So what is RuPay?

RuPay is a domestic, open loop, multilateral payments system to all banks and financial institutions in India which was launched on March 26, 2012.

It can support Debit, Credit and Prepaid cards.

Okay, so what is in it for me?

When you switch to RuPay, you get a welcome gift voucher from the bank as well as access to exclusive discounts.

All RuPay cards come with an in-built insurance and disability coverage and if you are a platinum card holder, you can access lounges in airports across the country.

It has also tied up with various international network partners and this means you can use your RuPay cards internationally.

The cards have also been enabled for e-commerce transactions using the Pay Secure technology whereby the existing ATM PIN is used for authentication instead of the additional password.

Did I manage to convince you of the many benefits of BHIM, UPI, and RuPay? NPCI ‘s initiative to revolutionize digital payments in India is really commendable. Do let me know over what you think in the comments below 🙂

We remember the day seven years back when were travelling in a Mumbai local trying hard to come up withe a name for our blog when struck us; Khushboo was always called a Jack of all Trades. The name stuck (with a slight modification, of course) and Minni was born. Six years, over 100 collaboration, lakhs of readers and several awards later; our love for blogging continues to grow. We continue to write on an eclectic range of topics from the funniest autorickshaw signs that we have spotted in Mumbai to how to bathe an elephant. We are true blue Munni of all Trades and we hope to continue on this joyride with our fellow Munnies and Munnas.

We remember the day seven years back when were travelling in a Mumbai local trying hard to come up withe a name for our blog when struck us; Khushboo was always called a Jack of all Trades. The name stuck (with a slight modification, of course) and Minni was born. Six years, over 100 collaboration, lakhs of readers and several awards later; our love for blogging continues to grow. We continue to write on an eclectic range of topics from the funniest autorickshaw signs that we have spotted in Mumbai to how to bathe an elephant. We are true blue Munni of all Trades and we hope to continue on this joyride with our fellow Munnies and Munnas.